FREE ZONE LICENSE

Free Zones are economic areas with advantageous tax and economic policies where goods and services can be traded within that area. In the UAE, each individual free zone has a specific focus on one or two commercial categories, such as creative and media companies. Although free zone companies are not allowed to trade outside their free zone, you can work with the distributor who can put your goods or services into the local market.

Types of Free Zone License

- Free Zone trading license

- Free Zone general trading license

- Free Zone consultancy/service license

- Free Zone industrial license

- Free Zone commercial license

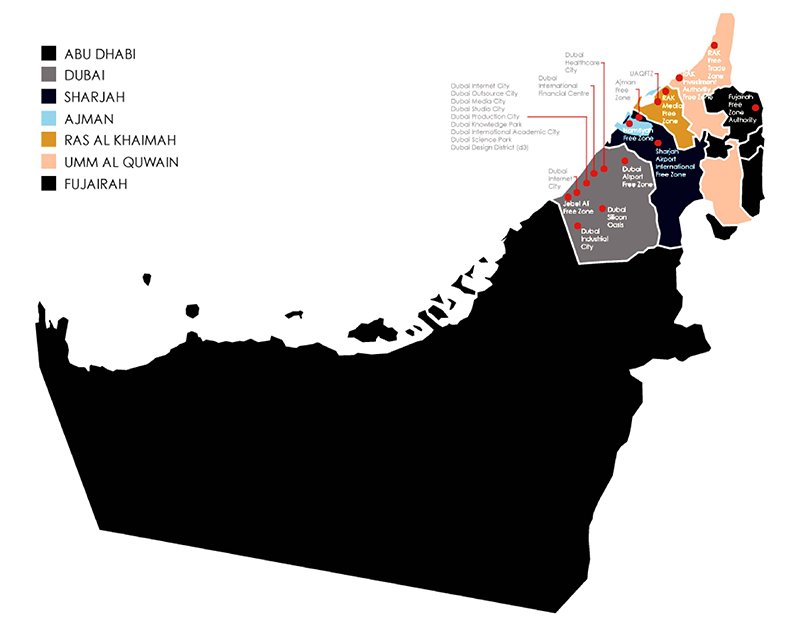

– Dubai Airport Free Zone (DAFZA)

– Jebel Ali Free Zone (JAFZA)

– Dubai Multi Commodities Centre (DMCC)

– Dubai Silicon Oasis

– Dubai World Central (DWC / Dubai South)

– Dubai World Trade Centre Free Zone

– Sharjah Airport International Free Zone (SAIF)

– Sharjah Research Technology and Innovation Park (SRTI)

– The U.S.A. Regional – Trade Centre (USARTC) Free Zone

– Hamriyah Free Zone

– Sharjah Media City Free Zone

– Ajman Free Zone

– Ajman Media City

– RAKEZ Business Zone

– Al Ghail Industrial Zone

– Al Hulaila Industrial Zone

– Al Hamra Industrial Zone

– RAKEZ Media Zone

– Fujairah Free Zone

– Creative City

Some Important Features

For free zone incorporation, little paperwork is required

Exempt from corporate, personal & VAT, import & export taxes

Company may also qualify for a residence visa or permit

100% foreign company ownership

No UAE national is required on the Board of Directors